Property Tax Pune can be paid both online and offline. Learn how to make PMC property tax payments using the online portal. Check your PMC property tax bill and obtain a receipt online.

Updates on PMC Property Tax

From April 1, 2024, the PMC Property Tax Department will issue Pune property tax bills via speed post.

Mar 19, 2024: The PMC property tax department has announced that starting April 1, 2024, Pune property tax bills will be sent to taxpayers via speed post. The department has taken this step to ensure that property tax bills are delivered promptly and payments are made on time. This will also help citizens who do not get their bills electronically. They’ll get hard copies of their bills and be able to pay their Pune property taxes on time.

According to Pune Municipal Corporation officials, 2.5 lakh taxpayers will receive their property tax bills via speed post during the first phase of the project. The municipal corporation has urged all city taxpayers to update their addresses with the department so that their property tax bills can be delivered without difficulty.

PMC Establishes Special Centre to Recover PMC Property Tax

Mar 12, 2024: The Pune Municipal Corporation has set up special call centres to collect PMC property taxes in Pune. The authority expects to recover about Rs 8500 crore by making 50,000 calls per month and 1000 to 1200 calls per day. For the first time, a municipal corporation has decided to communicate directly with tax defaulters. Calls will be placed on both weekdays and weekends. The Pune Municipal Corporation (PMC) intends to step up the drive, and follow-ups will be conducted.

About PMC Property Tax

Pune is a rapidly growing city near the metropolis of Mumbai. If you have a property in Pune, you must pay the PMC property tax. Learn how to pay your property tax and view your PMC property tax bill easily online. Pune’s proximity to the megacity makes it a significant real estate market. It serves as an industrial and educational hub. The city has some of the best infrastructure planning. It is also emerging as a smart city. All of these factors contribute to the profitability of owning property in this area. Are you looking to buy a property in Pune? Discover how to pay PMC property taxes online, as well as tax breaks, offline payment options, and more.

Overview of PMC Property Tax

The Pune Municipal Corporation (PMC) was established in February 1950. It has provided capable administration in the city for over 70 years. It oversees infrastructure, electricity, water, and other facilities. It has collected property taxes from both commercial and residential properties. Its jurisdiction encompasses over 6 lakh properties. PMC’s population is approximately 3.4 million. It has an area of about 331.26 square kilometers. If you own a shop, go-down, office space, factory, or home, you must pay PMC property taxes. This revenue is used to fund Pune’s development projects.

How to View PMC Property Tax Bills Online

Your primary concern should be to review your PMC property tax bill. Your bill reflects the amount of the pending PMC property tax.

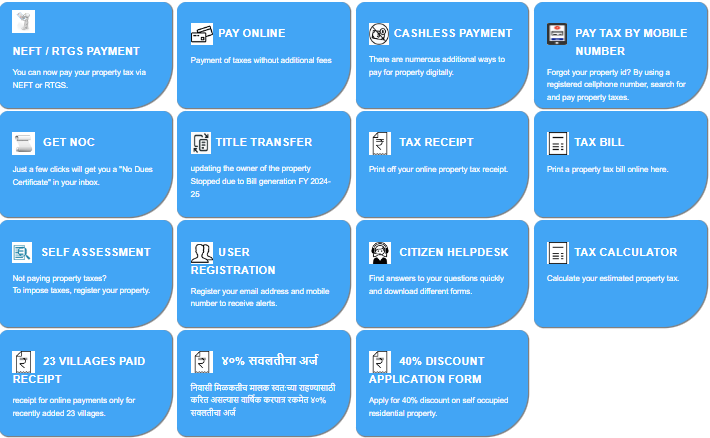

The first step is to visit the PMC property tax website (propertytax.punecorporation.org). This extensive page covers all property and tax options.

As soon as you arrive at the page, click ‘Tax Bill’. You’ll reach the bill details page.

Fill out the details in each box on the bill details page, then click ‘Submit’. You will see the bill amount on the screen.

PMC Property Tax Calculation

Many citizens prefer to pay their taxes in full or over six months. In this case, you might want to calculate your PMC property tax before getting the bill. Property tax is computed by multiplying the tax rate by the property’s capital value. The following factors determine the capital value of the property:

Building type

Age factor

Floor factor

Usage

Base value

Built-up area

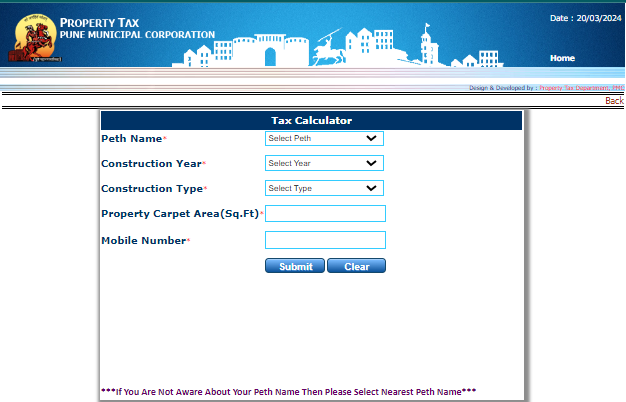

The PMC website features an online calculator that can calculate your PMC property tax in seconds.

You must visit the official PMC property tax website, https://propertytax.punecorporation.org

Select the option ‘Tax Calculator’. This will take you to the calculator’s webpage.

Fill in information such as ‘peth’s’ name, carpet area, construction type, and year. Click the ‘Submit’ button.

Property Tax Pune – Online Payment

PMC offers simple and straightforward methods to obtain the PMC property tax bill and payment options. Online payment of PMC property tax also results in a 2% rebate. There are two ways to access the property tax details page.

Option 1: Visit the property tax website, https://propertytax.punecorporation.org, and select the online payment option.

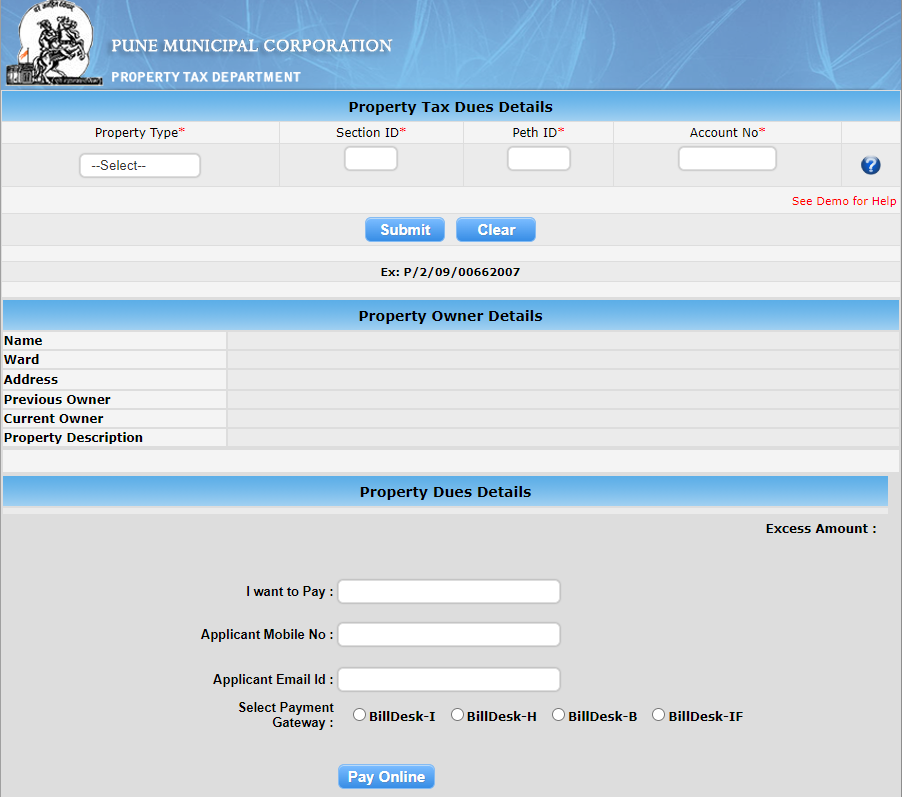

If you choose the NEFT/RTGS or Online option, you will be taken to the property tax information page.

Option 2: Visit the homepage of PMC’s government portal at https://www.pmc.gov.in/en/ptax

Choose ‘Online Services’ from the dropdown menu at the top, then ‘Pay Property Tax’. This will direct you to the property tax details page.

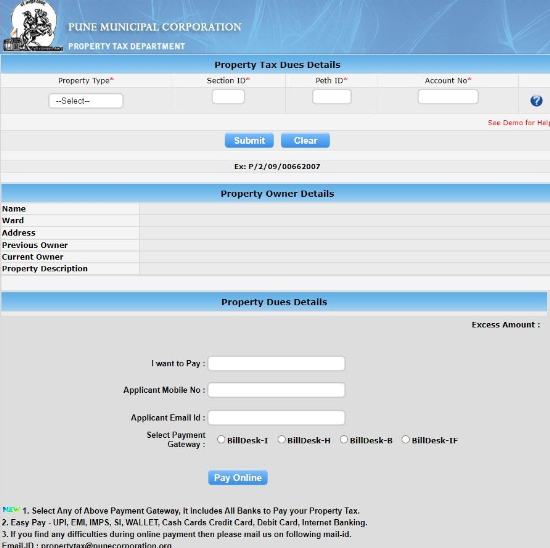

Before submitting, please enter the property type, section, and account number.

Examine the property owner’s information as shown on the page.

You can enter the amount you wish to pay. Confirm your mobile number and email address. Select the method of PMC property tax payment.

PMC Property Tax – Offline Payment

To pay PMC property tax offline, you must visit one of the tax payment centers. Offline payments can be made using cash, demand drafts, or checks. Some of the centres to visit are listed below.

There are ward offices in the Pune Municipal Corporation.

PMC has set up PMC property tax payment kiosks.

PMC has authorised some branches of Bank of Maharashtra, Cosmos Bank, HDFC, and ICICI.

PMC has also established citizen facilitation centres.

Rebates for PMC Property Tax

You can get a 2% rebate if you pay your PMC property tax online.

If you pay your entire annual tax bill by the end of May, you will be eligible for certain rebates. You are eligible for a 10% rebate if the rateable value is less than (up to) INR 25000. If your purchase exceeds INR 25000, you will receive a 5% discount.

Individuals with no outstanding debts qualify for an additional 5 lakh in accidental insurance coverage.

Installing any of our solar, vermiculture, or rainwater harvesting projects on your residential property will result in a 5% discount. If the society completes two of these projects, it will receive a 10% municipal tax refund.

Property used for public, worship, or religious purposes is tax-exempt. Properties registered as charitable trusts or institutions are also exempt from paying PMC property taxes.

Residential property owners with 40% disabilities are eligible for a 40% tax break.

Women, ex-servicemen, freedom fighters, and their families are also eligible for a 50% discount on PMC property taxes.

PMC Property Tax – Points to Remember

There is no additional fee for making payments via internet banking. However, payments made with cash, debit, or credit cards result in additional fees in addition to the payment amount.

PMC imposes a 2% late payment penalty every month.

After paying the PMC property tax, ensure that the updated record is reflected in the system.

PMC has started geotagging properties using Geographic Information System technology.

Pune Municipal Corporation is also referred to as Mahanagar Palika.

Aside from PMC property tax payments, the website offers services like NOC, title transfer, and application forms.

There are several options for easy online payment of PMC property taxes. Choose from NEFT/RTGS, net banking, other cashless payment options, and even mobile payments.

The PMC property tax payment period is divided into two halves per year. Payment is due by May 31st for the first half and December 31st for the second.

PMC frequently announces amnesty schemes to accommodate late payments on PMC property taxes.

The PMC property tax collected over Rs. 1845 crore in fiscal year 2022-23.

How to Contact the Pune Property Tax Department?

There are several options for contacting the Pune Property Tax Department’s help and support team.

Phone: The Pune Property Tax Department’s toll-free helpline number is 1800 1030 222.

To contact the Pune Municipal Corporation (PMC), send an email to info@punecorporation.org.

Please fax important documents to the team at 020 25501104.

You can also reach out to the team in person at their office in Shivajinagar, Pune. The PMC office address is PMC Building, Near Mangla Theatre, Shivajinagar, Pune – 411 005, Maharashtra, India.

Summing Up – PMC Property Tax

PMC is the administrative body responsible for collecting PMC property taxes on all residential, commercial, and institutional properties in Pune. The payment of PMC property tax has been simplified by offering both online and offline options. There are several options for making an online payment for Pune property taxes. PMC has set up a number of locations and centres where you can make offline payments. PMC also provides a variety of rebates to encourage tax payments. Paying by the due date results in a 2% rebate.

If You Are Looking for a Commercial Property For Lease or Sale in Pune then you are at right Place.